Real Estate NFT Marketplace: Everything You Need to Know

February 09, 2024

Ayush Kanodia

.jpg?w=1920&q=75)

Consider this situation: You’ve been eyeing a piece of real estate for months, citing it as the perfect investment opportunity. However, juggling through the complex process of property transactions leaves you feeling overwhelmed and uncertain. From complicated paperwork to lengthy negotiations, traditional real estate transactions often come with significant hurdles for both buyers and sellers.

Having said that, there is a solution that could simplify this process and make property transactions effortless, secure, and accessible to everyone. We are talking about Real Estate NFTs here. These unique digital assets, powered by blockchain technology, offer a promising solution to optimize and revolutionize the way we engage in property transactions.

In this blog, we'll take a closer look at Real Estate NFT marketplace development and their transformative potential, and understand their significance in simplifying real estate transactions while paving the way for new opportunities in the market.

Understanding NFTs

Non-Fungible Tokens (NFTs) are unique digital assets that are authenticated using blockchain technology, making each token distinct and irreplaceable. Unlike cryptocurrencies such as Bitcoin and Ethereum, which are fungible and interchangeable, NFTs represent ownership of specific digital or physical assets, ranging from art and collectibles to real estate properties.

How NFTs Work

NFTs operate on blockchain networks, which are decentralized and immutable ledgers that record ownership and transaction history. Each NFT contains metadata that provides information about the asset it represents, including its origin, ownership history, and any associated rights or licenses. This data is stored on the blockchain to ensure transparency and security.

When a person purchases an NFT, they acquire ownership rights to the underlying asset, which can be anything from digital art to virtual real estate. The transaction is recorded on the blockchain, establishing a verifiable chain of ownership. NFTs can be bought, sold, and traded on various online platforms known as marketplaces, where users can browse, discover, and interact with NFTs.

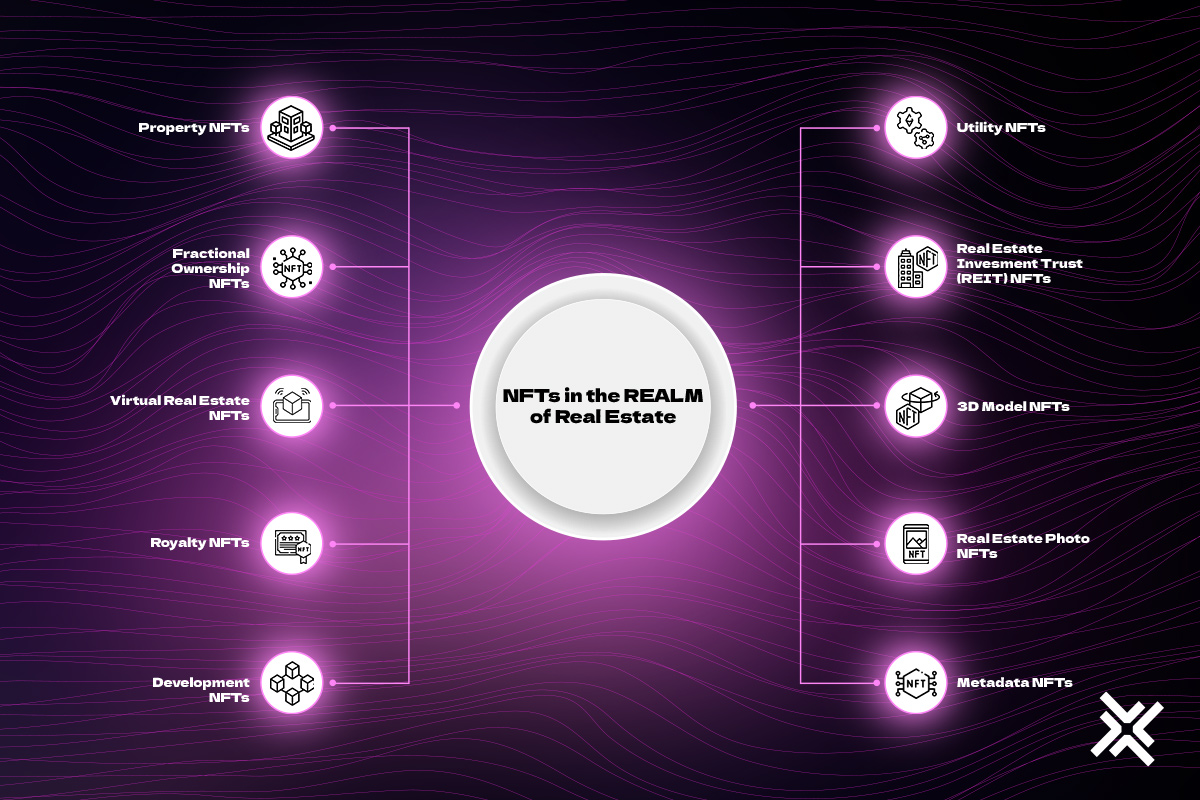

There is a wide range of NFTs available, spanning various categories such as digital art, collectibles, virtual real estate, music, gaming assets, and more. Each type of NFT caters to different interests and preferences, catering to a diverse audience of creators and collectors.

The Intersection of Real Estate and NFTs

Real estate is a physical and tangible asset. So how can NFTs be applied to it? The answer is by tokenizing property or converting real estate properties and assets into NFTs. This novel approach of utilizing NFTs to digitize and tokenize real estate assets, which are often characterized by lengthy transaction processes, enables fractional ownership, efficient transactions, and increased liquidity in the market. (Here fractional ownership means dividing a property into multiple NFTs that represent a share or a percentage of the property. This allows investors to own a portion of a property without the need for large capital and also increases the liquidity and accessibility of real estate investments.)

The intersection of real estate and NFTs is not limited to physical properties, however. There is also a growing market for virtual real estate, or digital properties that exist in virtual worlds or metaverses. These properties can also be tokenized as NFTs, allowing users to buy, sell, and trade virtual land, buildings, and spaces. Some virtual real estate NFTs are also tied to physical properties in the real world, creating a bridge between the digital and physical worlds.

Potential benefits of using NFTs in Real Estate

The utilization of NFTs in real estate transactions offers several potential benefits for the stakeholders involved.

- Lowering the barriers to entry and increasing the liquidity of real estate investments. By tokenizing property, investors can access a global market of buyers and sellers, and also diversify their portfolio by owning fractions of multiple properties. Tokenizing property also reduces commissions, taxes, and legal expenses associated with traditional real estate transactions.

- Reducing the costs and complexities of real estate transactions and ownership. By using blockchain technology, NFTs, eliminate the need for intermediaries, paperwork, and physical transfer. Moreover, NFTs can automate the execution of contracts and payments through smart contracts.

- Enhancing the security and trust of real estate transactions and ownership. NFTs can ensure the security and immutability of the property data and ownership records, preventing fraud, forgery, and disputes. Furthermore, each NFT has a unique identification code and metadata that distinguish it from other tokens, verifying the authenticity and provenance of the property.

Challenges and Considerations in Using NFTs for Real Estate Transactions

Despite the potential benefits, the integration of NFTs in real estate transactions presents certain challenges and considerations. One of the primary challenges is regulatory uncertainty, as the legal framework surrounding real estate NFTs is still evolving, leading to potential compliance issues and regulatory hurdles.

Additionally, there are concerns regarding the valuation and pricing of real estate NFTs, as the market for tokenized properties is relatively nascent and lacks established pricing mechanisms.

Furthermore, technical challenges such as scalability, interoperability, and gas fees on blockchain networks can pose obstacles to the widespread adoption of real estate NFTs.

Although there are challenges to overcome, there are several notable examples of white label NFT marketplace development and initiatives that demonstrate the practical application of this technology in the industry. For instance, platforms like Decentraland and CryptoVoxels enable users to buy, sell, and trade virtual real estate assets using NFTs, creating virtual worlds where users can interact and engage in various activities.

Real Estate NFT Marketplace Explained

The Real Estate NFT Marketplace is a digital platform where users can buy, sell, and trade tokenized real estate assets using Non-Fungible Tokens (NFTs). These NFTs can be either virtual or physical, meaning they can represent digital properties in the metaverse or real-world properties in the physical world.

Typically, on a real estate NFT marketplace, the property can be easily transferred, exchanged, or fractionalized without the need for intermediaries, paperwork, or physical transfer.

A real estate NFT marketplace allows users to discover and invest in various properties and assets across the globe, by browsing, bidding, and buying NFTs on the platform. It makes the industry more accessible, transparent, and efficient.

Functionality and Features of Real Estate NFT Marketplaces

Real Estate NFT Marketplaces offer a range of functionality and features designed to facilitate efficient transactions and enhance user experience.

- Listing and Discovery: Users can list their tokenized properties on the marketplace, complete with detailed descriptions, images, and pricing information. Buyers can browse through listings to discover properties that match their preferences.

- Fractional Ownership: Real estate NFT marketplace app development services facilitate fractional ownership, allowing multiple investors to purchase and own fractions of property through NFTs. This democratizes access to real estate investments and reduces barriers to entry.

- Smart Contracts: Transactions on the Real Estate NFT Marketplace are facilitated by smart contracts, which automate the execution of agreements between buyers and sellers. Smart contracts ensure transparency, security, and immutability of transactions.

Secondary Market: Users can buy, sell, and trade real estate NFTs on the secondary market, providing liquidity to investors and leading to price discovery for tokenized properties.

Key Players and Platforms in the Real Estate NFT Marketplace

The Real Estate NFT Marketplace is populated by a variety of platforms and players, each offering unique services and features.

- OpenSea: One of the largest NFT marketplaces, OpenSea offers a wide range of digital assets, including real estate NFTs. Users can buy, sell, and trade tokenized properties on the platform.

- Decentraland: A virtual reality platform built on blockchain, Decentraland allows users to buy, sell, and trade virtual real estate assets represented by NFTs. Users can explore, build, and monetize virtual worlds within Decentraland.

- CryptoVoxels: Similar to Decentraland, CryptoVoxels is a virtual world platform where users can buy, sell, and build on virtual real estate parcels represented by NFTs. The platform allows for creative expression and social interaction within a decentralized virtual environment.

Case Studies or Success Stories from Real Estate NFT Marketplace

Several real estate NFT projects and initiatives have achieved success and garnered attention in the industry. For example:

The Sandbox: A virtual gaming platform built on blockchain, The Sandbox allows users to create, own, and monetize virtual assets represented by NFTs, including virtual real estate parcels. The platform has attracted millions of users and generated significant revenue through NFT sales.

Metaverse Group: A real estate development company, Metaverse Group specializes in tokenizing physical properties and selling them as NFTs on blockchain platforms. The company has successfully tokenized several high-value properties, offering investors the opportunity to own fractions of prestigious real estate assets.

How to Participate in Real Estate NFT Marketplace

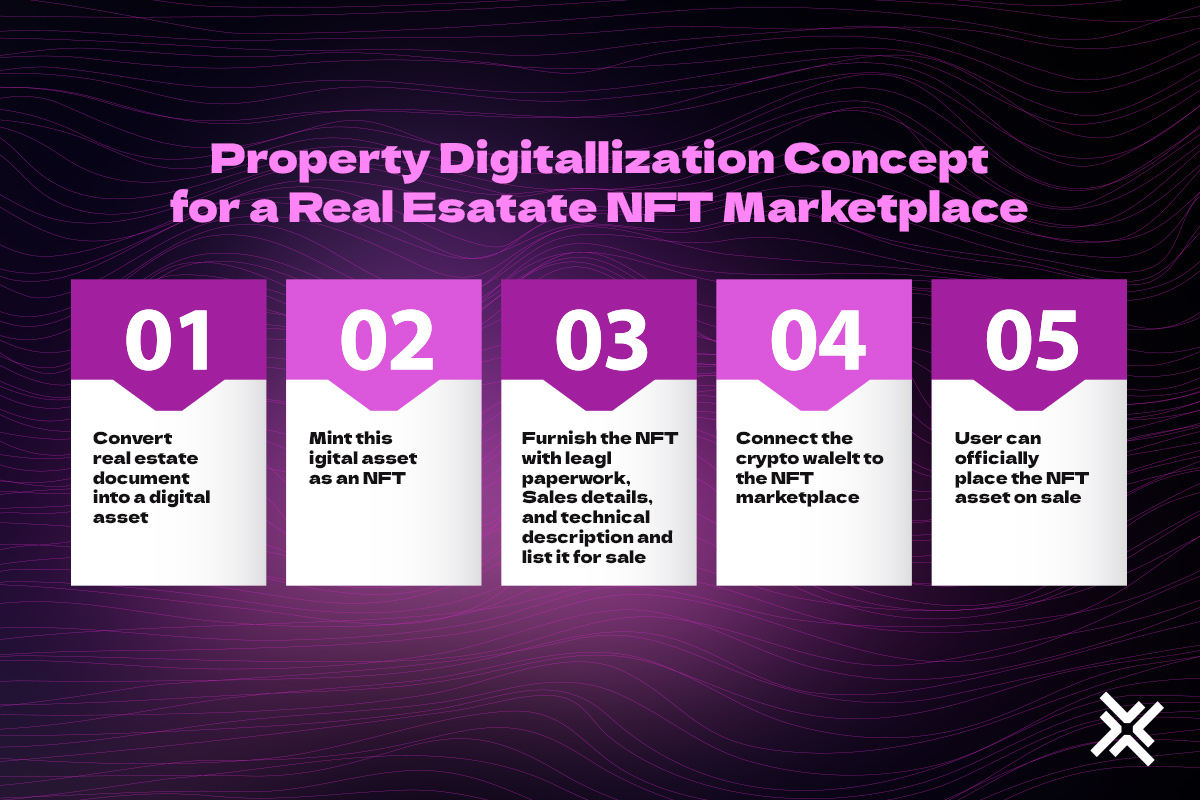

Participating in the Real Estate NFT Marketplace offers an opportunity to explore innovative ways of buying, selling, and investing in real estate assets. Follow the steps below to ensure a successful and smooth process if you want to create and list your own real estate NFTs on a marketplace.

Digitize the Property: The first step in creating Real Estate NFTs is to digitize the property by tokenizing its ownership rights on a blockchain platform. This involves identifying the property, gathering relevant documentation, and creating a digital representation of the property's ownership.

Choose a Marketplace: Select a Real Estate NFT Marketplace where you intend to list your tokenized property. Consider factors such as platform reputation, user base, fees, and listing requirements when choosing a marketplace.

Connect your crypto wallet: You need to have a digital wallet that allows you to store, manage, and transfer your NFTs and cryptocurrencies on the platform. Connect your wallet to the platform and ensure that you have enough funds to cover the creation and listing fees. Some examples of crypto wallets are MetaMask, Coinbase Wallet, and Trust Wallet.

Create the NFT: Once you’ve chosen a marketplace and connected your crypto wallet, the next step is to create the NFT for your property by minting it on the blockchain. This involves generating a unique digital token that represents ownership rights to the property, along with metadata that describes the property's attributes and ownership history. You’ll also need to create a smart contract that defines the rules and terms of your NFT transaction, such as the price, the commission, the royalties, and the escrow. (Platforms often provide templates or builders to create smart contracts; some even automate the process for you.)

List the NFT: After minting the NFT, list it for sale on the chosen marketplace. Provide detailed information about the property, including images, descriptions, pricing, and any additional terms or conditions.

Market and Promote: Market and promote your listed NFT to attract potential buyers. Utilize social media, online forums, and other marketing channels to reach a wider audience and generate interest in your property.

Factors to Consider Before Participating in Real Estate NFT Marketplace

Before you decide to participate in a real estate NFT marketplace, either as a creator or a buyer, you need to consider some factors that could affect your experience and outcome.

- Ensure compliance with relevant laws and regulations governing real estate transactions and blockchain technology in your jurisdiction.

- Conduct thorough market research to understand current trends, pricing dynamics, and demand for real estate NFTs in the marketplace.

- Choose a reputable, reliable, top NFT Marketplace app development company that aligns with your goals and preferences.

- Understand the tokenization process and associated costs, including minting fees, gas fees, and any other expenses involved in creating and listing Real Estate NFTs.

Risks and challenges associated with Real Estate NFT Marketplace

Participating in the Real Estate NFT Marketplace comes with its share of risks and challenges, including:

Regulatory Uncertainty: Regulatory frameworks surrounding real estate NFTs are still evolving, leading to uncertainty and potential regulatory risks for participants.

Market Volatility: Real estate NFTs may be subject to price volatility, influenced by factors such as market demand, investor sentiment, and external events.

Security Concerns: Security vulnerabilities in blockchain platforms and smart contracts pose risks of hacking, theft, and unauthorized access to NFTs and associated assets.

Liquidity Constraints: Real estate NFTs may face liquidity constraints, limiting the ability to buy, sell, or trade assets due to limited market activity or lack of interested buyers.

Despite the challenges and uncertainties, the future of regulations in the Real Estate NFT Marketplace is likely to be more supportive and optimistic. There is a growing adoption and adaptation of the existing laws and regulations to accommodate and facilitate the growth of real estate NFTs, such as the incorporation of blockchain technology and smart contracts into property registration and transaction systems.

Future Trends and Developments

Looking ahead, the Real Estate NFT Marketplace is still in its nascent stage, but it is already showing signs of rapid and remarkable growth and evolution. It is set for continued innovation, driven by emerging trends, technological advancements, and evolving consumer preferences.

Emerging Trends in Real Estate NFT Marketplace

The Real Estate NFT Marketplace is witnessing several emerging trends, including the tokenization of diverse real estate assets such as residential properties, commercial buildings, land parcels, and even virtual real estate in metaverse platforms.

Fractional ownership models, decentralized finance (DeFi) integration, and cross-chain interoperability are also emerging trends shaping the future of real estate NFTs.

Potential Impact on the Traditional Real Estate Industry

The Real Estate NFT Marketplace has the potential to disrupt the traditional real estate industry by democratizing access to property investments, increasing market liquidity, and introducing new models of property ownership and financing. Traditional real estate players, including developers, brokers, and investors, are increasingly exploring opportunities in the NFT space to leverage digital innovation and derive value from the market.

Here are some of the new opportunities and possibilities for the real estate industry.

- Innovation and diversification of the products and services

- Expansion and penetration of the markets and segments

- Collaboration and innovation among the stakeholders

- Social and environmental impact of the properties.

Predictions for the Future of Real Estate NFT Marketplace

Predictions for the future of the Real Estate NFT Marketplace include continued growth, maturation, and mainstream adoption of real estate NFTs as a viable asset class. As regulatory frameworks evolve and market infrastructure matures, the Real Estate NFT Marketplace is expected to attract greater institutional participation, driving innovation, liquidity, and investment opportunities in the market. Additionally, the integration of emerging technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) is expected to enhance user experience and expand the possibilities of real estate NFTs in the digital era.

Wrapping Up

The real estate marketplace represents a bold step forward in the evolution of the real estate industry. By adapting to innovation, staying informed about regulatory developments, and exploring the diverse opportunities available, participants can position themselves for success in this emerging market. So whether you’re a seasoned investor or a first-time buyer, it is the perfect time to discover the amazing possibilities of Real Estate NFTs and how they can revolutionize your future.

If you are interested in creating your own Real Estate NFTs and leveraging their potential for your business or investment portfolio, contact us at WDCS today to learn more about our NFT development services. Whether you want to tokenize your property, buy or sell NFTs, or integrate them with other platforms, our NFT website development company can assist you with every step of the process. Don’t miss this opportunity to be part of the future of real estate. Get in touch with us now and let us help you turn your vision into reality.

Stay ahead of the curve with our comprehensive real estate NFT marketplace development

NFTs are revolutionizing the real estate industry and this is the perfect opportunity to take advantage of it. Hire WDCS to develop an efficient real estate NFT marketplace and dominate the competition.